This segment illustrates an example of a company research on Electronic Arts prepared in 2014.This presentation provides some examples of the information to focus on when researching a company. You will generally find that we are providing increasing layers of granularity as the presentation progresses.

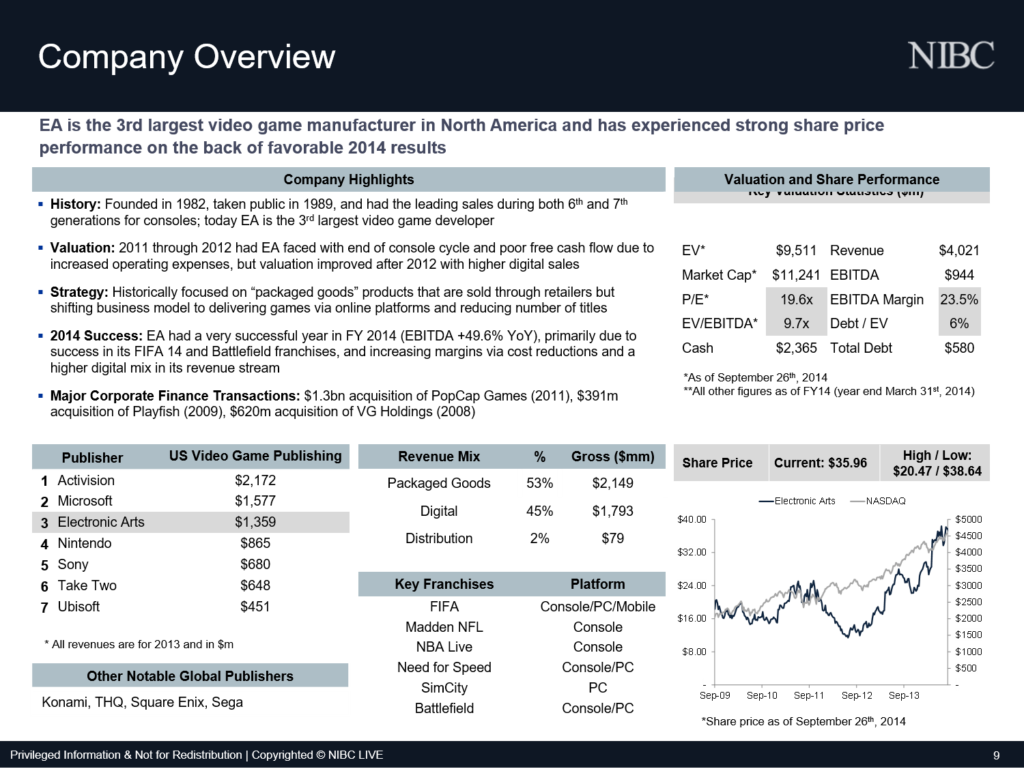

COMPANY OVERVIEW

The first slide here is a snapshot of the company’s highlights, valuation and core business focus.

From this you can quickly tell that:

- EA is a major publisher with significant sports franchises

- Its valuation has been struggling in 2011-2012 but recently picked up including following an exceptionally strong year in 2014

- EA’s strategy is to focus on fewer but bigger titles, online delivery of games and expansion into mobile & Free-to-Play games through M&A

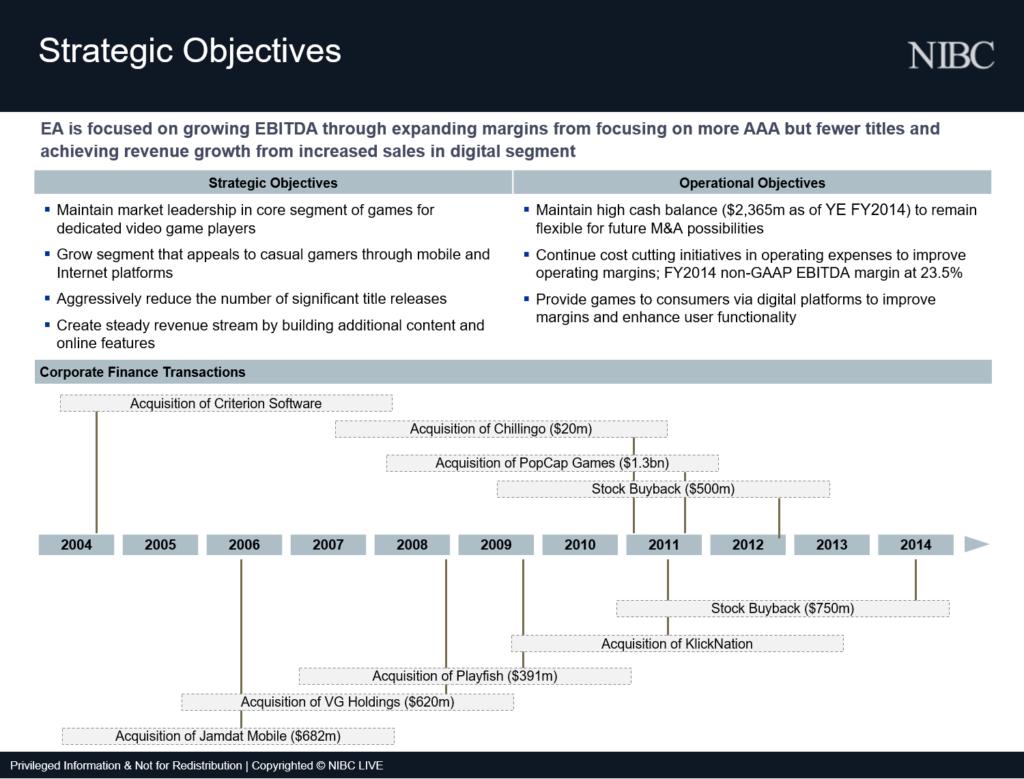

STRATEGIC OBJECTIVES

The next slide summarizes the operational and strategic objectives of EA as well as recent M&A activity.

While EA has been a market leader in the Console and PC segment, it is now focused on creating fewer but bigger blockbuster titles. At the same time it has made several acquisitions into the growing Mobile and Free-to-Play segment.

It is also looking to continue improving cost efficiency and has conserved significant balance sheet capacity for M&A activity.

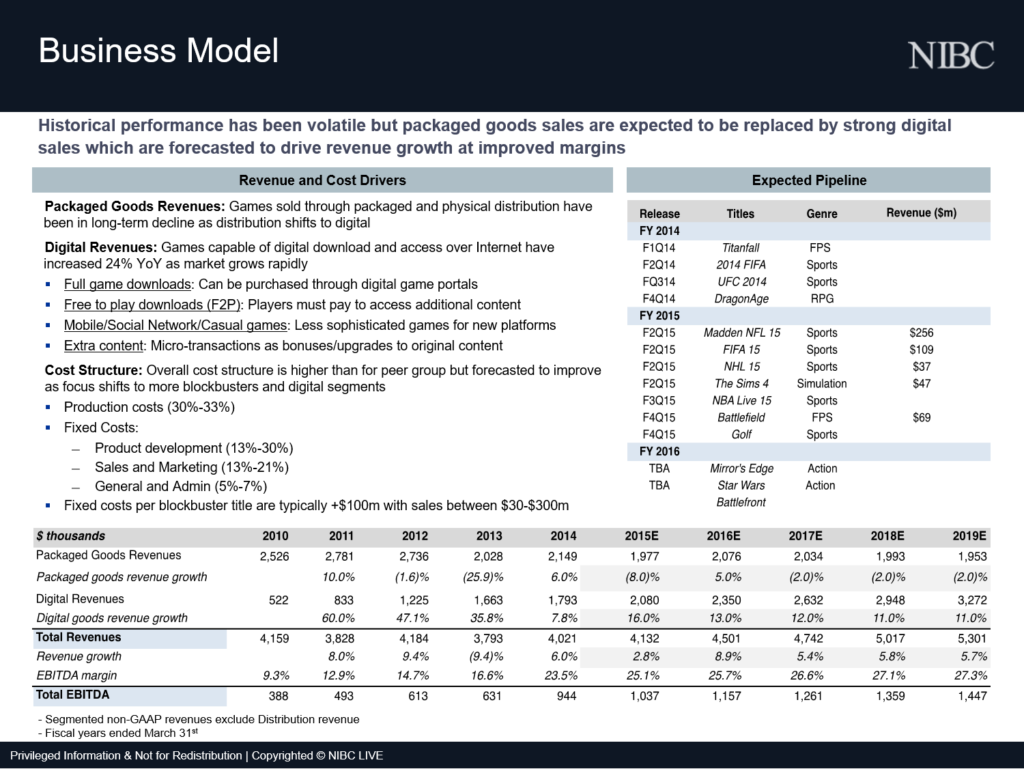

BUSINESS MODEL

This slide provides further information on EA’s business model by looking into its revenue segments and cost categories as well as past operating performance.

A closer look reveals that EA’s packaged goods revenues are declining as customers shift to digital delivery and the share of revenues from Mobile & Free-to-Play games steadily increases, which are part of digital revenues.

The main costs categories comprise product development, sales & marketing and some general administration.

Looking at the past performance, you can see that revenues have historically fluctuated within a narrow range, while EBITDA has been quite volatile.

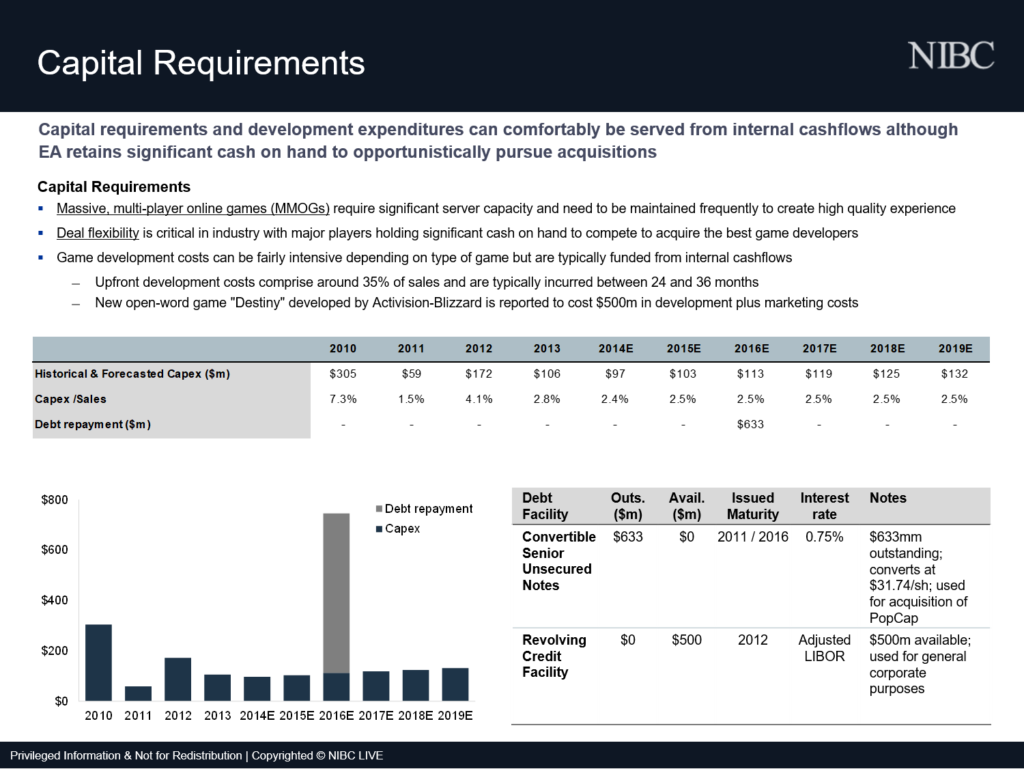

CAPITAL REQUIREMENTS

Continuing on the previous slide, EA’s main capital requirements relate to development costs and repayment of debt but are relatively small compared to operating costs.

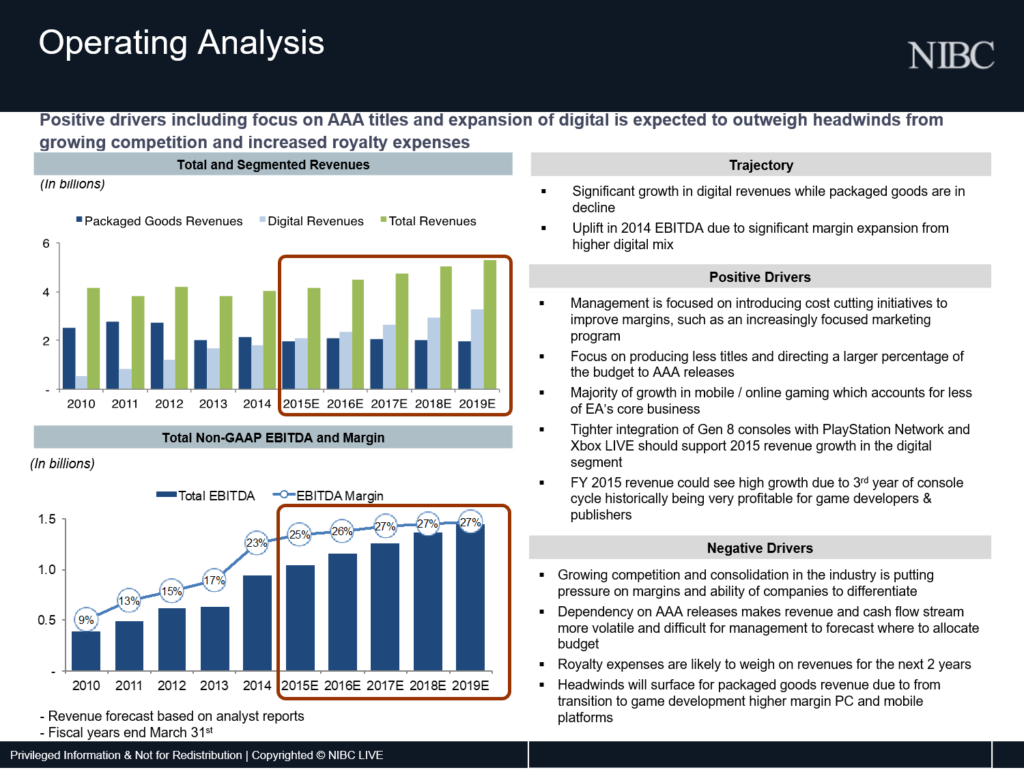

OPERATING ANALYIS

This side provides an analysis of EA’s forecasted operating performance. The forecast looks positive and is supported by a consumer shift to digital product delivery, production shift to fewer but bigger titles, and overall growth in mobile gaming.

However, EA’s forecast is somewhat exposed to growing consolidation by rivals, dependency on repeated blockbuster titles and high royalty expenses. Nonetheless, it appears EA has good momentum to achieve its forecast.

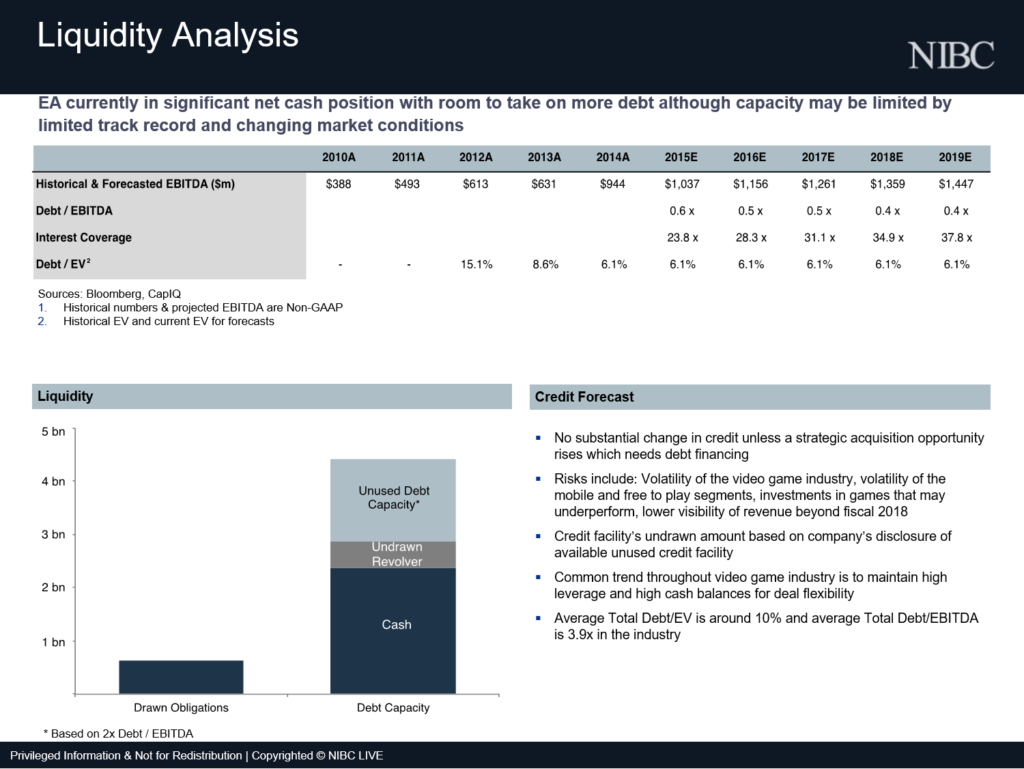

LIQUIDITY ANALYSIS

After looking at its operating performance, the next slide describes EA’s liquidity position which suggests EA has significant unused balance sheet capacity to raise debt to make an acquisition. However, the industry is volatile in nature and EA’s EBITDA margin has changed drastically over the years, which could reduce its borrowing ability.

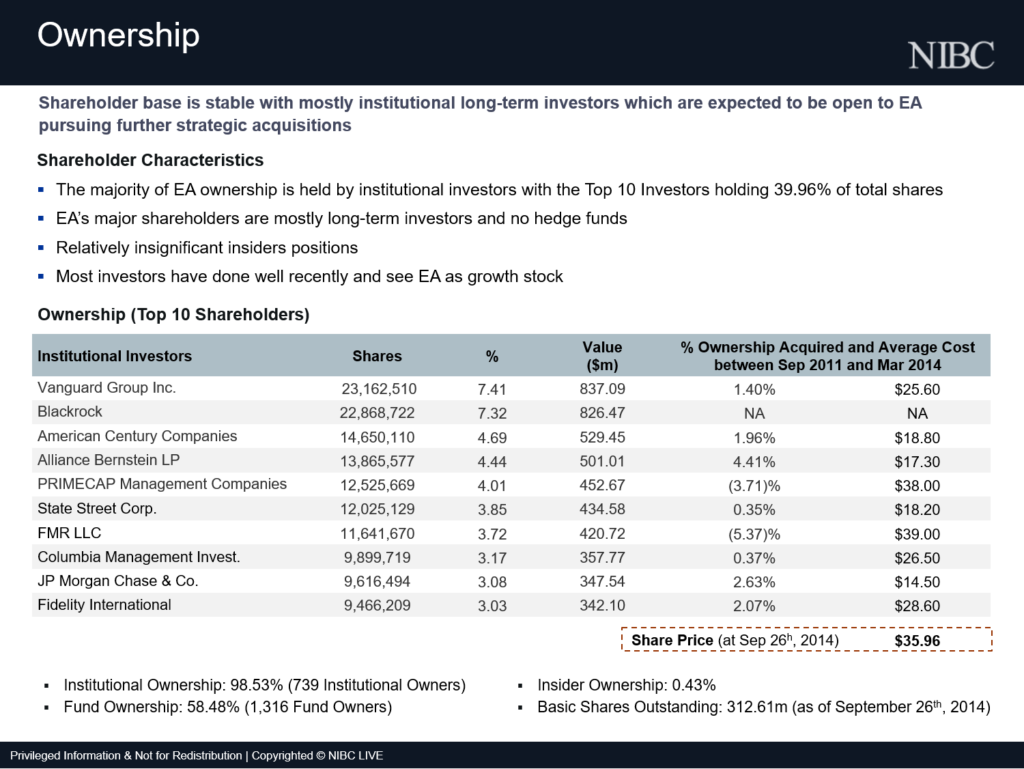

OWNERSHIP

Finally, we provide a quick review of EA’s shareholder base, which is dominated by long-term institutional investors, most of which have incurred attractive gains in recent years.